Sentetik Varlık Nedir?

Kripto ekosisteminde yenilikçi finansal araçlar, kullanıcıların yatırım fırsatlarını genişletirken, geleneksel finans ile merkeziyetsiz finans (DeFi) dünyası arasındaki sınırları da yumuşatıyor. Bu araçlardan biri de “sentetik varlıklar”dır. Temel olarak sentetik varlıklar, başka bir varlığın değerini yansıtan ve onu dijital ortamda temsil eden tokenlerdir. Yani bu varlıklar; altın, hisse senedi, tahvil veya bir endeks gibi standartlaşmış varlıklarının fiyat hareketlerini blok zinciri üzerinde izlenebilir ve dönüştürülebilir hâle getirirler.

Kriptoda Sentetik Varlıklar

Kripto perspektifinden bakıldığında ise sentetik varlıklar, kullanıcıların belirli bir varlığa fiziksel olarak sahip olmadan onun fiyat hareketlerinden yararlanmasını sağlar. Bu, hem yatırım stratejilerini çeşitlendirmek hem de küresel piyasalara erişim sağlamak isteyenler için büyük bir esnekliktir. Üstelik tüm bu süreçler, akıllı sözleşmelerle desteklenen şeffaf ve merkeziyetsiz bir altyapıda gerçekleşir.

Sentetik varlıkların en önemli özelliklerinden biri, blok zincirinde işlem görebilmeleri sayesinde küresel ölçekte erişilebilir olmalarıdır. Geleneksel piyasalardaki coğrafi ve düzenleyici kısıtlamalar, DeFi ortamında büyük ölçüde ortadan kalkar. Bu sayede, örneğin ABD borsasında listelenmiş bir teknoloji şirketinin fiyatına dayalı sentetik bir token, dünyanın herhangi bir yerindeki tüccarlar tarafından satın alınabilir.

Sentetik Varlıklar Ne İşe Yarar?

Kripto sentetik varlıkların temelinde akıllı sözleşmeler ve teminat mekanizmaları bulunur. Kullanıcılar, sentetik bir varlık oluşturmak için genellikle sistemde teminat olarak kripto parasını kilitler. Bu teminat, varlığın değer dalgalanmalarına karşı güvence işlevi görür. Teminatlandırma oranı (collateralization ratio) çoğu protokolde %100’ün üzerindedir; böylece ani fiyat hareketleri durumunda sisteme borçlanma durumu önlenir.

Fiyat eşleştirme (price feed) süreci ise merkeziyetsiz oracle’lar tarafından sağlanır. Oracle’lar, geleneksel varlıkların fiyat verilerini blok zincirine taşır ve akıllı sözleşmelere iletir. Böylece, sentetik varlığın fiyatı, dayanak varlığın piyasa fiyatıyla senkronize olur.

Bu yapı sayesinde kullanıcılar, teminatlarını koruyarak dayanak varlığın fiyat hareketlerinden pozisyon alabilirler. Fiziksel varlığı elde etme, saklama ya da transfer gibi süreçler ise ortadan kalkar; tüm işlemler dijital ortamda, blok zinciri üzerinde gerçekleşir.

Sentetik Varlıkların Kullanım Alanları

Sentetik varlıklar, yalnızca fiyat takibi yapmak için değil, çeşitli stratejiler ve yatırım senaryoları için de kullanılabilir. Söz konusu kullanım alanlarından bazılarını sizler için aşağıda listeledik.

Portföy Çeşitlendirme

Yatırımcılar, tek bir ekosistem üzerinden farklı varlık sınıflarına erişim sağlayabilir. Örneğin, hem kripto hem de hisse senetlerini temsil eden sentetik varlıklar aynı cüzdanda tutulabilir.

Hedge (Riskten Korunma) Amaçlı İşlemler

Geleneksel varlık üzerinde pozisyonu olan bir yatırımcı, fiyat dalgalanmalarına karşı kendini korumak için zıt yönde sentetik pozisyon alabilir.

Likidite Sağlama

Merkeziyetsiz borsalarda sentetik varlık havuzları likidite sağlayıcılarına ek kazanç fırsatları sunar.

Erişim Engellerini Aşma

Coğrafi veya yasal kısıtlamalar nedeniyle doğrudan erişilemeyen varlıklara, sentetik versiyonlar üzerinden yatırım yapılabilir.

Deneme ve Simülasyon

Geleneksel varlık almadan fiyat hareketlerini analiz etmek ve strateji test etmek için kullanılabilir.

Kripto Sentetik Varlıkların Avantajları

Sentetik varlıkların popülerleşmesinin ardında birkaç temel neden vardır. Tek bir listede şu şekilde özetleyebiliriz:

- Küresel Erişim: Coğrafi sınırlamaları aşarak, dünyanın her yerinden yatırım imkânı sunar.

- Likidite: Merkeziyetsiz borsalarda işlem görebilir, 7/24 erişilebilir.

- Çeşitlendirme: Kullanıcıların farklı varlık sınıflarına aynı ekosistem üzerinden yatırım yapmasına imkân tanır.

- Şeffaflık: Tüm işlemler blok zinciri üzerinde kayıtlıdır.

- Maliyet Avantajı: Aracı kurumlara ihtiyaç duymadan yatırım yapılabilir.

Sentetik Varlıkların Dezavantajları ve Riskleri

Her yatırım aracında olduğu gibi sentetik varlıklar da risk barındırır. En yaygın riskler arasında teminat volatilitesi, oracle manipülasyonları ve likidite sorunları yer alır. Özellikle kripto teminatın fiyatında ani düşüş yaşanması, sentetik varlık pozisyonlarının likidasyonuna yol açabilir. Oracle manipülasyonu ise fiyat verilerinin hatalı iletilmesine ve bu hatalara bağlı işlem risklerinin ortaya çıkmasına neden olabilir.

Ayrıca, bazı ülkelerde sentetik varlıkların regülasyon belirsizliği söz konusudur. Düzenleyici kurumlar, sentetik varlıkları menkul kıymet olarak sınıflandırabilir, bu da ilgili projelerin faaliyetlerini sınırlayabilir. Kullanıcılar, işlem yaptıkları platformun yasal statüsünü ve güvenlik önlemlerini mutlaka göz önünde bulundurmalıdır.

Öne Çıkan Sentetik Varlık Coinleri

Kripto dünyasında sentetik varlık alanında öncü kabul edilen projelerden biri Synthetix’tir (SNX). Ethereum üzerinde çalışan bu protokol, kullanıcıların sentetik USD, altın, petrol ve hatta kripto endeksleri gibi birçok varlığı temsil eden tokenler oluşturmasına imkân tanır. Yüksek teminat oranları ve merkeziyetsiz yönetişim modeliyle bilinir.

Bir diğer örnek Mirror Protocol projesi, Terra ekosisteminde geliştirilen ve geleneksel hisse senetlerini yansıtan sentetik varlıklar sunar. Kullanıcılar, Apple, Tesla veya Amazon gibi şirketlerin fiyatlarına dayalı sentetik tokenler oluşturabilir ve bunları merkeziyetsiz borsalarda işlem görebilir.

UMA (Universal Market Access) ise daha esnek bir model sunar. Kullanıcıların kendi belirlediği şartlara göre finansal sözleşmeler düzenlenmesine olanak tanır, bu da sentetik varlık çeşitliliğini artırır.

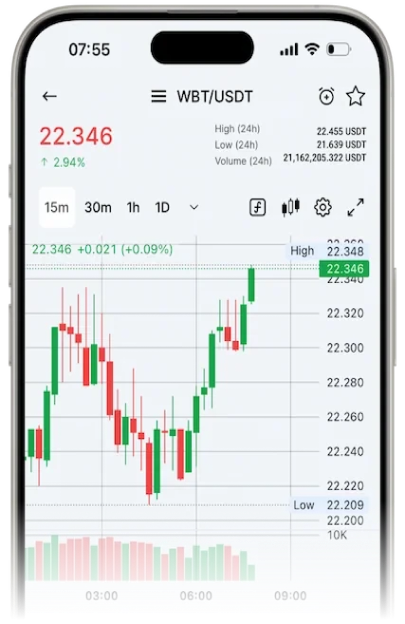

Kripto Paraların Piyasa Değerleri

Sentetik Varlıklar ile Türev Ürünler Arasındaki Fark

Sentetik varlıklar, türev ürünlerle benzer bir mantıkta fiyat takibi yapsa da, yapısal olarak farklıdır. Türev ürünler genellikle vadeli işlem sözleşmeleri veya opsiyonlar şeklinde organize borsalarda işlem görür. Sentetik varlıklar ise doğrudan blok zincirinde yaratılır, saklanır ve transfer edilir. Ayrıca, türev ürünler merkezî kuruluşlar tarafından yönetilirken, sentetik varlıklar tamamen akıllı sözleşmelerle otomatikleştirilmiştir.

Sentetik Varlıkların Geleceği

Sentetik varlıklar, hem geleneksel finansı hem de kripto borsalarını dönüştürme potansiyeline sahip araçlar olarak görülüyor. Özellikle DeFi protokollerinin gelişmesi, daha güvenilir oracle sistemlerinin yaygınlaşması ve hukuki belirsizliklerin netleşmesiyle birlikte, sentetik varlıkların kullanımının artması beklenir.

Ayrıca, zincirler arası köprülerin gelişmesi sayesinde, farklı blok zincirleri üzerinde oluşturulmuş sentetik varlıkların birlikte çalışabilirliği artacak. Bu da kullanıcıların çok daha geniş bir yatırım yelpazesine, tek bir ekosistem üzerinden erişebilmesini mümkün kılacak.

S.S.S.

Sentetik varlık, geleneksel/standartlaşmış bir varlığın (altın, hisse senedi, endeks vb.) fiyatını blok zinciri üzerinde temsil eden dijital bir token türüdür. Dayanak varlığa sahip olunmadan, onun fiyat hareketlerinden kazanç sağlama imkânı tanır.

Bir DeFi protokolünde, belirli bir kripto para teminat olarak kilitlenir. Bu teminat, akıllı sözleşmeler aracılığıyla dayanak varlığı temsil eden sentetik bir token üretir. Teminat oranı, sistemin güvenliğini sağlamak için genellikle %150 gibi yüksek seviyelerde tutulur.

Yasal durum, bulunduğunuz ülkenin regülasyonlarına bağlıdır. Bazı ülkeler bu varlıkları menkul kıymet olarak değerlendirirken, bazıları henüz net bir düzenlemede bulunmamıştır. Bu nedenle işlem yapmadan önce bulunduğunuz bölgenin konuya ilişkin yasal çerçesini araştırmak gerekir.

Doğrudan yatırımda varlığı fiziksel olarak ya da yasal mülkiyet belgesiyle elde edersiniz. Sentetik varlıkta ise yalnızca fiyatına maruz kalırsınız. Örneğin, sentetik altın aldığınızda fiziksel altın sizde bulunmaz; fiyat değişimlerinden dijital ortamda etkilenirsiniz.

Ethereum üzerindeki Synthetix, Terra tabanlı Mirror Protocol ve çok zincirli çözümler sunan UMA, sentetik varlık alanında en bilinen projelerdir. Bu platformlar, farklı varlık türleri için çeşitli teminatlandırma modelleri ve işlem seçenekleri sunar.

Tek Tıkla Kripto Dünyasını Keşfet!